Complete Procedure for Becoming a tax filer in Pakistan

A filer is a person who is an active taxpayer and whose name is displayed on active taxpayer list. The list is updated by FBR on weekly basis. The list is upgraded after that income tax returns filed by taxpayers. The advantage of becoming the tax filer in Pakistan is that you have to pay half of your total income tax.

Step by Step Guide for Tax Filer:

To become an active filler, you have to go through this simple process.

1.Register NTN:

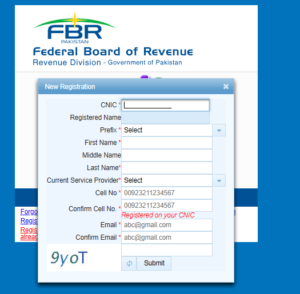

First of all, you must have an NTN (National Tax Number) number. If you don’t have then please apply for this first by visiting the FBR official site. You will see an online form for new registration. Fill it carefully and submit it. After that, log in to the site and fill the application form saved in draft. Later submit it and you will get your number within an hour.

2.Income Estimation and Certification:

Now, you have to make a rough estimation of your income based on the salary and expenses for salaried person. In the case when you are a businessman, know the profit by expenses and sales. Later on, took a glance at the payable taxes such as banking, bills, sales and purchase taxes. Now, grab the certificates from all the institutes where you have paid the tax. Collect all the tax paid and make a subtotal of the total paid amount.

3.Evaluate your Assets and Expenses:

Make a fair evaluation of your assets whether received from any source through any method. The assets usually include cars, buildings, property, currency, gold etc. now, make a rough estimation of your personal expenses like electricity, gas, water, vehicle, taxes, and aids. Note that, the estimation is rough and ups and downs are acceptable.

4.Register in IRIS System:

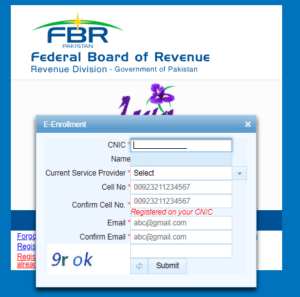

Now you have to register in IRIS system by getting through the FBR site to become a tax filer in Pakistan. Here click one E-Enrollment person and form will be opened as shown below. Fill the form carefully and all done. After getting in this system, you have to file a text return and you will become a filler within a weak.

How to your Check Filer Status:

Once you have successfully applied to become a filler, you need to check your name on the list. Here are some ways to do so.

- Firstly, go to the FBR site, download the list of active taxpayers, search your name manually in the list

- Secondly, type ATL space your CNIC and send it at 9966. You will receive a tax confirming your name in the list.

- Thirdly, go to the FBR site and click on taxpayer list. Type your CNIC and your status of the tax will be displayed in minutes.

Related Article | How to File Complaint about Cyber-Crime – Complete Detail